They called it a revolution. They called it a populist firestorm. They called it justice. They were wrong. Last week, I explained the GameStop short squeeze — where it came from, how it happened, and why it was viewed as important. At the same time, I refrained from addressing many of the obvious legal questions implicated by the squeeze, as well as how it involved Robinhood. There were a few reasons for this — the article was starting to run long, I wanted to take some more time to think through some of the questions, and most importantly, I wanted to wait for the dust to settle and for the market to settle down a little bit. After all, if the pricing trends continued at the rate they were going, GameStop would be one of the most valuable companies on the market!

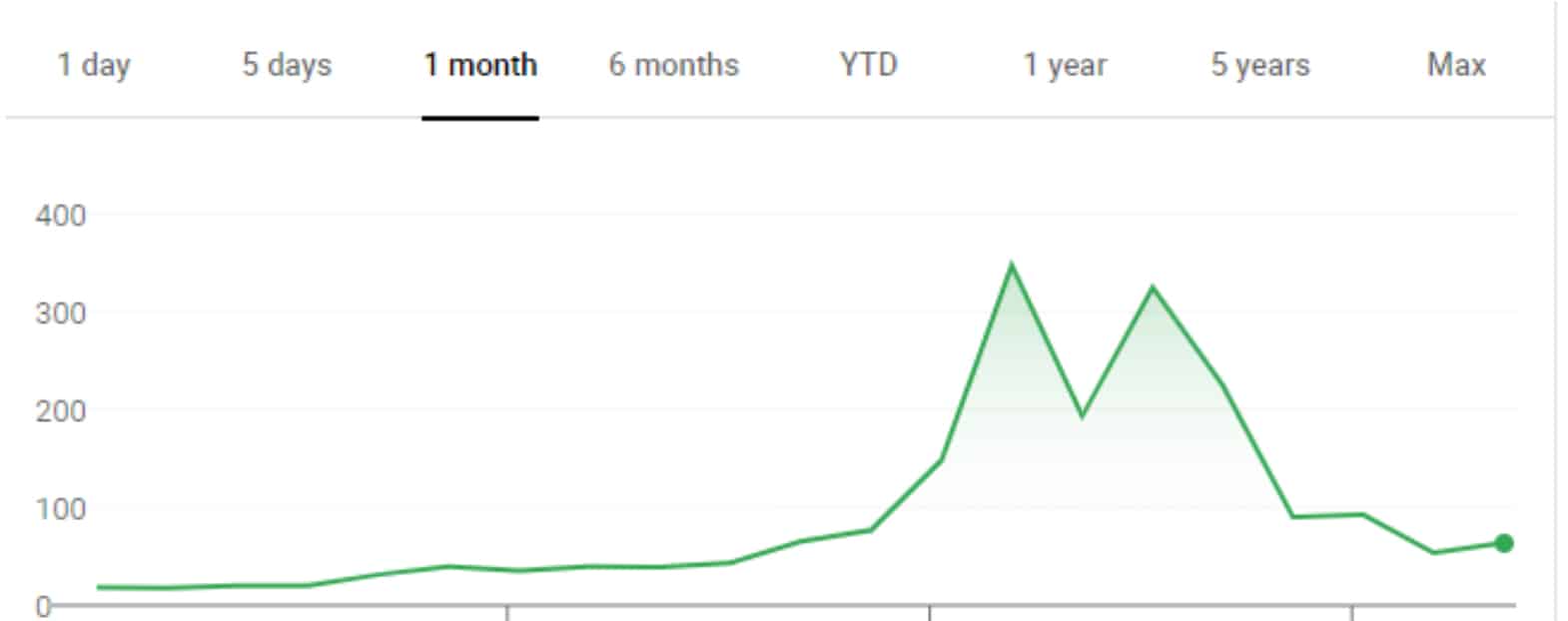

As it turns out, my instincts were correct — there have been several developments over the past week that add a lot of clarity to what happened. First, and most importantly, the share price for GameStop (and other stocks that were going through the same process) plummeted as the short squeeze reached its natural conclusion. Second, we learned that the overwhelming majority of retail traders (i.e., folks trading on Robinhood) sold their GameStop stock during the short squeeze and that the share price continued to increase despite these sales. This means that, at its zenith, the short squeeze was really a feud amongst and between wealthy institutional investors, or, as one commentator put it, “GameStop madness isn’t David vs. Goliath. It’s Goliath vs. Goliath, with David as a fig leaf.”

While Reddit may have “lit the powder keg,” as I wrote last week, this was hardly a situation where the “common man” ganged up on the rich and made them pay for their greed.

These facts provide useful context for our consideration of the legal questions. So let’s get to it!

Are Short Squeezes Illegal? Was This Short Squeeze Illegal?

No. Short squeezes aren’t illegal. They aren’t fraudulent and don’t even qualify as “market manipulation.” Instead, as explained last week, “short squeeze” is simply the term used to describe what happens when a particular stock or security is over-shorted, leading to an increase in the stock price. Because the short-sellers eventually have to purchase the stock, their short-sales serve as an indicator that, at some definite point in the future, there will be significant demand for the stock. In turn, that could (and, in the case of GameStop, did) lead others to buy that stock in anticipation of the increase in demand.

This is not to say that there is no legal risk associated with short squeezes. To the contrary, the fact that a stock is over-shorted can lead to market volatility, which is itself conducive to fraud and other market abuses. This is because, when a market is volatile, traders are afraid that they will move too late and are thus likely to pounce on any perceived movement in the market. That tendency, in turn, means that short squeezes leave the market susceptible to pump-and-dump schemes and other kinds of financial fraud. The fact that most trading is conducted using high-frequency-trading computers with imperfect algorithms exacerbates these kinds of problems.

At this point, it does not appear that the GameStop squeeze itself was the product of illegal market manipulation or fraud. Instead, the mere fact that 160% of GameStop shares were shorted provided savvy investors (retail and non-retail alike) with more than enough reason to buy the stocks. Nevertheless, I can virtually guarantee that, in the coming months, regulators will uncover numerous fraudulent schemes that were made possible from the uncertainty and fear surrounding the squeeze.

Why Did Robinhood Suspend Trading? Was That Illegal?

The short version: Robinhood’s decision to suspend trading is almost certainly not illegal.

There are in fact several plausible reasons why Robinhood may have limited or suspended trading in connection with GameStop (and AMC, Nokia, etc.) shares, and none of them are illegal.

First and second, Robinhood suspended trading to avoid excessive financial liability and to fulfill its legal obligations. Robinhood’s stated reason for suspending trading is that it lacked the capital needed to cover the trades. The actual mechanics behind Robinhood’s trades are pretty complicated, but for present purposes, it suffices to say that Robinhood is required to have a certain amount of cash on hand to cover or fulfill transactions that go south. As GameStop transactions were going haywire — in both quantity and pricing — the amount of cash Robinhood needed to have to cover its trades quickly exceeded the cash Robinhood had on hand.

Thus, in this version of events, Robinhood had a choice: continue to allow trades in violation of contractual obligations and at the risk of being unable to cover positions that ended badly, or limit trading at the risk of alienating customers. Obviously, Robinhood chose the latter and, for good measure, sought a billion dollars (!) in emergency funding to ensure it remained in compliance with the obligations it had already accrued.

Third, Robinhood may have been motivated by a desire to protect its users from a volatile market and disastrous trading conditions. The conventional wisdom — which turned out to be true — is that GameStop’s high share price was unsustainable and that at some point the price was going to tumble. Suspending trades would protect users from investing in a company that was doomed to failure. As others have pointed out, Robinhood may be especially sensitive to widespread customer losses after one of its customers committed suicide after racking up what he believed was hundreds of thousands in debt.

Fourth, Robinhood may have wanted to slow trading to avoid scrutiny from regulators or lawmakers. This is linked to the previous explanation, as mass customer losses would likely increase calls for a regulatory crackdown. Although, the irony with this explanation is that it was the decision to suspend trading that contributed the most to calls for increased regulation.

Of course, there are more cynical theories out there. Some people think that Robinhood suspended trading to prevent its institutional investors from losing money on their GameStop positions. That theory isn’t especially plausible. For one thing, as explained above, institutional investors were profiting from the increase in GameStop’s share price. For another thing, Robinhood makes its money by routing shares to institutions that execute on those trades — they call it “payment for order flow.” Thus, suspending trading would only serve to reduce Robinhood’s profits.

Did Robinhood Breach Its Contracts with Its Customers?

The fact that Robinhood’s trading suspension wasn’t illegal from a regulatory perspective doesn’t mean that the suspension was permissible from a contract perspective. Do Robinhood’s customers have a claim against Robinhood for breach of contract? Once again, the answer is no. In fact, Robinhood’s terms of service explicitly state that it can suspend trading at any time.

More importantly, Robinhood only prevented traders from opening new positions. Because users were free to close out their GameStop positions, they cannot claim that Robinhood left them holding the bag. And as far as new trades were concerned, nothing prevented Robinhood users from purchasing shares through other brokers or services. To put it more simply, Robinhood customers aren’t legally entitled to unlimited access — or even any access — to the Robinhood trading platform. I expect the bevy of lawsuits asserting these kinds of claims to fail.

Where Does GameStop Go from Here?

Nowhere. There was thought that GameStop could leverage its high share price to score additional funding. But the fact that the high prices were based on already existing shares, in tandem with the fact that the share prices have since plummeted, means that GameStop can’t really leverage the event for any meaningful gain, beyond additional press and name recognition. But even the additional press isn’t anything to write home about — instead of being known for video games, GameStop will be associated with the likes of Blackberry, Nokia, and numerous other failed or failing companies. That’s hardly a ringing endorsement.

Closing Thoughts

I’ve never liked GameStop. I’ve browsed GameStop quite a few times over the years (usually as a hideaway when my parents were grocery shopping next door), and I can’t even recall an occasion where I saw a game that wasn’t grossly overpriced relative to what I could find it for at other competing retailers, or where GameStop’s trade-in price wasn’t grossly underpriced. With that background in mind, it’s only fitting that GameStop’s stock would, in the span of just a few weeks, exhibit both of those deficiencies — at first vastly underpriced, then vastly overpriced.

If GameStop is on its way out — and I truly believe it is — it’s only fitting that its last hurrah lives up to the suckage that defined GameStop for its entire existence. Good riddance.

Published: Feb 7, 2021 03:00 pm